Hey there, fellow financial adventurers! Ever feel like the world of trends">investing is a giant, intimidating maze, especially when you’re just starting out with a small amount of money? Don’t worry, you’re not alone. Many people feel overwhelmed by the complexity of investing, particularly when they don’t have a lot to work with. But what if I told you there’s a surprisingly simple strategy that can level the playing field and help you build wealth steadily, even with limited funds? That strategy is called dollar-cost averaging (DCA), and it’s your secret weapon in the micro-investing-tools">micro-investing-strategies">micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing game.

Let’s be honest, the idea of investing can seem daunting. Images of Wall Street tycoons and complex financial jargon often flood our minds. But investing doesn’t have to be exclusive to the elite. Micro-investing, which involves investing small amounts regularly, is perfectly accessible to everyone. And DCA makes it even easier.

What is Dollar-Cost Averaging (DCA)?

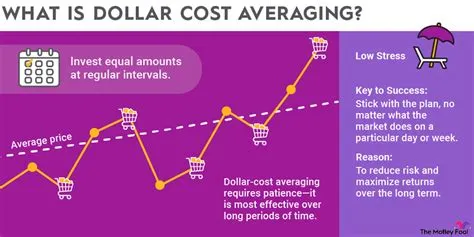

Imagine you’re buying apples. Would you rather buy a huge batch all at once, hoping the price stays low, or would you buy a smaller amount each week, regardless of the price fluctuations? DCA is like buying those apples consistently over time. Instead of investing a lump sum all at once, you invest a fixed dollar amount at regular intervals (weekly, monthly, etc.).

This means you buy more shares when prices are low and fewer shares when prices are high. It’s like automatically taking advantage of market dips without having to constantly monitor the market and try to time your investments perfectly—a nearly impossible task, even for seasoned professionals!

Why is DCA Perfect for Micro-Investors?

For micro-investors, DCA is a game-changer. Here’s why:

- Minimizes Risk: DCA reduces the risk of investing a large sum at a market peak. Remember the apple analogy? If you bought all your apples at the highest price of the season, you’d be disappointed. DCA spreads out your investment over time, lessening the impact of any single price point.

- Emotional Discipline: DCA takes the emotion out of investing. It’s easy to get swept up in market hype or panic and make impulsive decisions. With DCA, you stick to your plan, regardless of short-term market volatility. It’s like setting your autopilot and letting the system work for you.

- Accessibility: DCA is incredibly accessible. You can start with as little as $5 or $10 a week. Many brokerage apps now allow for automatic investments, making it even easier to implement.

- Consistency Builds Wealth: The magic of DCA lies in its consistency. Small, regular investments, compounded over time, can accumulate into significant wealth. Think of it like building a strong brick wall; one brick at a time may not seem impressive, but together, they create something solid and substantial.

- Easy to Manage: DCA doesn’t require complex financial knowledge or constant market monitoring. You simply set it up and let it run. It’s like having a personal financial assistant that works for you 24/7, without demanding a high salary.

How to Implement DCA for Micro-Investing

Getting started with DCA is surprisingly straightforward:

- Choose Your Investment Vehicle: Index funds or exchange-traded funds (ETFs) are excellent choices for beginners, offering diversification and low fees. Consider your risk tolerance and investment goals when making your selection.

- Determine Your Investment Amount: Start small! Even $5 or $10 a week can make a difference over time. Choose an amount you can comfortably afford without impacting your essential expenses.

- Set Up Automatic Investments: Most brokerage apps allow you to automate your investments, taking the hassle out of manually investing each week or month. This is crucial for sticking to your plan.

- Be Patient and Persistent: DCA is a long-term strategy. Don’t get discouraged by short-term market fluctuations. Stay disciplined, keep investing regularly, and let the power of compounding work its magic.

- Review and Adjust (Occasionally): While you shouldn’t constantly tinker with your strategy, it’s good practice to periodically review your investment performance and adjust your contributions as your financial situation changes.

Beyond the Basics: Advanced DCA Strategies

While the basic DCA strategy is incredibly effective, there are some advanced techniques you can explore as you gain more experience:

- Variable Dollar-Cost Averaging: Instead of a fixed dollar amount, you adjust your contributions based on your income or other factors. This allows for greater flexibility and can increase your investment amounts during periods of higher income.

- DCA with Multiple Assets: You can use DCA to invest in different asset classes, such as stocks, bonds, and real estate, to further diversify your portfolio and manage risk.

- DCA and Tax-Advantaged Accounts: Maximize the benefits of tax-advantaged accounts like 401(k)s and IRAs by using DCA to contribute regularly.

Overcoming Obstacles to Successful DCA

Even the simplest strategies face challenges. Here are some common obstacles and how to overcome them:

- Fear of Missing Out (FOMO): Seeing the market soar can trigger FOMO, tempting you to invest a lump sum. Remember, DCA minimizes the risk of investing at a market peak.

- Discipline: Sticking to a plan requires discipline. Set reminders, automate your investments, and visualize your long-term financial goals to stay motivated.

- Lifestyle Changes: Unexpected expenses or income changes can disrupt your DCA plan. Build flexibility into your strategy by allowing for adjustments as needed.

Conclusion

Dollar-cost averaging is a powerful tool that demystifies investing, especially for micro-investors. It’s a simple, accessible, and effective strategy that allows you to build wealth consistently, even with limited funds. By embracing the power of consistent, small investments, you’re taking control of your financial future and paving the way toward achieving your financial goals. So, take that first step, start small, stay consistent, and watch your wealth grow! Remember, the journey of a thousand miles begins with a single step (and a small, regular investment!).

FAQs

- Is DCA suitable for all types of investors? While DCA is generally beneficial, it might not be the best approach for everyone. Investors with a high risk tolerance and a large lump sum might find other strategies more suitable. Consult with a financial advisor to determine the best approach for your specific circumstances.

- What if the market consistently goes down? Even with DCA, you might experience losses during prolonged market downturns. However, DCA helps mitigate the impact of such losses by averaging out your purchase price over time. The key is to stay the course and continue investing.

- Can I use DCA with individual stocks? You can, but it’s generally riskier than using DCA with diversified investments like index funds or ETFs. Individual stocks can be more volatile, potentially leading to significant losses if the company underperforms.

- How often should I review my DCA strategy? A yearly review is usually sufficient, but you may want to review it more frequently if your financial situation changes significantly or if you notice significant market trends.

- What are the fees associated with DCA? The fees will depend on your chosen brokerage platform and investment vehicles. Choose low-cost brokers and investment options to maximize your returns.