Hey there, savvy investors! Ever feel like the world of investing is a bit… intimidating? Like it’s only for the super-rich with fancy suits and even fancier portfolios? Well, think again! micro-investing-tools">micro-investing-strategies">micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing is changing the game, making investing accessible to everyone. But to really understand where this exciting trend is headed, we need to look at the bigger picture – the global demographic shifts shaping our future. So grab a coffee, settle in, and let’s dive into ten key trends influencing micro-investing by 2025.

1. The Rise of the Millennial and Gen Z Investors: Let’s face it, millennials and Gen Z are digital natives. They’re comfortable with technology, and that translates directly into embracing user-friendly micro-investing apps. They’re also more likely to view investing as a long-term strategy, not just a get-rich-quick scheme. Think of it like this: they’re building their financial future, one small investment at a time, much like building a Lego castle – brick by brick. This demographic’s sheer size alone is a massive driver of micro-investing growth.

2. The Growing Gig Economy and Freelance Workforce: The gig economy isn’t going anywhere. More and more people are working freelance or in the gig economy, and that brings about financial unpredictability. Micro-investing offers a solution; it’s a flexible way to save and invest, even with irregular income streams. It’s like having a safety net you can contribute to incrementally, regardless of how busy your work schedule is.

3. Increasing Financial Literacy: While still a work in progress, financial literacy is improving globally. More people understand the basics of investing and see the long-term benefits of starting early, even with small amounts. It’s like learning to ride a bike – once you get the hang of it, you can go further and faster. Increased financial knowledge fuels the adoption of micro-investing platforms.

4. The Democratization of Investing Through Technology: Gone are the days when investing required a minimum of thousands of dollars and a broker’s fee. Micro-investing apps have broken down those barriers, making investing accessible via smartphones. Think of it as the Uber of investing – convenient, accessible, and available at your fingertips. This accessibility is directly fueling micro-investing’s popularity.

5. Growing Demand for Passive Income Streams: With the increasing cost of living, the demand for passive income is rising. Micro-investing presents a pathway to generating passive income over time, even if it starts small. This is a crucial trend – people are actively seeking ways to supplement their income, and micro-investing is becoming a significant part of that plan.

6. Increased Awareness of Inflation and Economic Uncertainty: Global economic uncertainty and inflation are pushing more people towards seeking ways to protect their savings. Micro-investing, while not a foolproof inflation hedge, is perceived as a better alternative to keeping money in a low-interest savings account. It’s like building a financial shelter against the storms of economic volatility.

7. The Rise of Socially Responsible Investing (SRI): Younger generations are increasingly driven by values, and this is shaping their investment choices. Many micro-investing platforms now offer SRI options, allowing individuals to align their investments with their social and environmental values. It’s like making your money work for both your financial goals and your conscience.

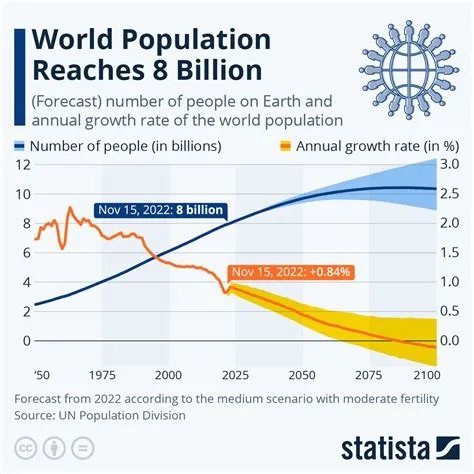

8. The Aging Population and Retirement Planning: As populations age in many developed countries, the need for secure retirement planning is more critical than ever. Micro-investing can complement other retirement savings strategies, providing a supplementary income stream. It’s a crucial addition to the pension plan, a way to boost your savings over the long term.

9. The Expanding Middle Class in Developing Countries: A rapidly expanding middle class in many developing nations creates a large pool of potential new micro-investors. As disposable incomes rise, these individuals seek investment options, and micro-investing apps are perfectly positioned to cater to this need. It’s a massive untapped market, ripe for growth.

10. Government Initiatives and Regulations Supporting Financial Inclusion: Governments in many countries are actively promoting financial inclusion, often supporting initiatives that make investing more accessible. This regulatory encouragement is a significant tailwind for micro-investing, creating a favorable environment for its expansion.

Conclusion:

Micro-investing is more than just a trend; it’s a revolution. Driven by these ten powerful demographic shifts, it’s transforming the way people approach their finances, making investing accessible to a broader spectrum of society than ever before. Whether you’re a millennial building wealth, a gig worker seeking financial security, or someone simply looking to diversify their savings, micro-investing offers a powerful tool to reach your financial goals. It’s a testament to the changing times, where technology and accessibility are democratizing the world of finance, one small investment at a time.

FAQs:

1. Is micro-investing safe? While no investment is entirely risk-free, reputable micro-investing platforms employ security measures to protect your funds. However, it’s essential to research the platform before investing and understand the associated risks.

2. How much money do I need to start micro-investing? Many platforms allow you to start with very small amounts, sometimes as low as a few dollars. This low barrier to entry is a key element of its appeal.

3. What are the potential downsides of micro-investing? Potential downsides include limited diversification compared to larger portfolios and the impact of fees if not carefully managed. Always read the fine print and understand what you are paying for.

4. Can I lose money through micro-investing? Yes, as with any investment, you can lose money. The market fluctuates, and the value of your investments can go up or down. This is a risk you need to accept.

5. How do I choose a reputable micro-investing platform? Look for platforms with a strong track record, transparent fees, robust security measures, and positive user reviews. It’s always advisable to research multiple options.