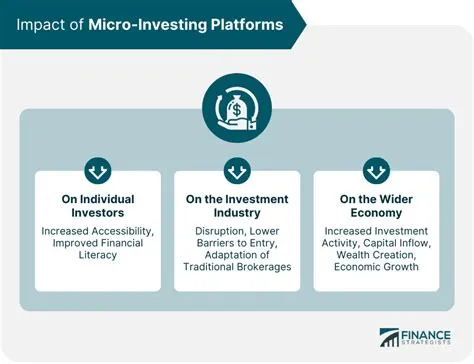

Hey there, fellow investors! Ever felt like you needed a simpler, more accessible way to dip your toes into the world of finance? That’s where trends">micro-investing-tools">micro-investing-strategies">micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing platforms come in – they’re revolutionizing how we save and invest. But, like any rapidly growing industry, micro-investing is facing some interesting regulatory shifts. Let’s dive into five key trends shaping the future of these platforms.

1. The Rise of KYC/AML Compliance:

Remember those annoying identity verification steps when you open a new bank account? Well, micro-investing platforms are feeling the same pressure. Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are tightening globally. Why? Because governments are determined to combat financial crime. Think of it as a giant security net – preventing bad actors from using these platforms for illicit activities. For micro-investing platforms, this means investing heavily in robust verification systems. It’s a cost, sure, but it builds trust and ensures a safer environment for everyone. It’s like getting a security system for your house – it might cost you, but it’s worth it for peace of mind.

This heightened scrutiny isn’t just about paperwork; it’s about using sophisticated technology to detect suspicious activity. This is crucial for maintaining the integrity of the entire micro-investing ecosystem. So, if you’re seeing more rigorous identity checks, don’t be surprised – it’s a sign of a maturing industry prioritizing security.

2. Data Privacy and Security Regulations:

In today’s digital world, your data is gold. And micro-investing platforms hold a treasure trove of it – your financial information, investment choices, even your spending habits. That’s why data privacy and security regulations, like GDPR in Europe and CCPA in California, are becoming increasingly important. These regulations are like a digital fortress, designed to protect your personal information from unauthorized access and misuse.

Micro-investing platforms need to prove they can securely store and manage your data. This means robust cybersecurity measures, transparent data handling policies, and clear explanations of how your information is used. Think of it like choosing a strong password for your online accounts; it’s about protecting your valuable assets. It’s no longer enough to say they’re secure; they need to demonstrate it. These regulations push platforms to continuously enhance their security posture and build user trust.

3. Increased Transparency and Disclosure Requirements:

Remember those tiny print disclaimers on financial documents? Well, those days might be numbered. Regulators are pushing for more transparency in how micro-investing platforms operate. This means clear, concise explanations of fees, investment strategies, and risk levels. Imagine it like cooking a recipe; you wouldn’t want to leave out crucial ingredients, right? Similarly, platforms must be upfront about all aspects of their services.

This push for transparency is aimed at empowering investors. Instead of being buried under jargon, investors can now make informed decisions based on clear, understandable information. This move towards greater clarity is beneficial to both the investor and the platform, fostering a culture of trust and accountability.

4. The Growing Focus on Financial Literacy and Investor Protection:

Micro-investing platforms have democratized investing, making it more accessible to a wider audience. But with increased access comes increased responsibility. Regulators are emphasizing financial literacy programs, ensuring investors understand the risks involved before investing. Think of it as a driver’s education course before getting behind the wheel of a car – it’s about ensuring people are prepared before they start.

This focus on investor protection is crucial. It’s not just about protecting people from scams; it’s about promoting responsible investing habits. Regulators are looking at ways to ensure that investors are making informed decisions, even if it’s their first time investing.

5. Cross-Border Regulation and Harmonization:

In an increasingly globalized world, micro-investing platforms often operate across borders. This creates a challenge for regulators, as different countries have different rules. The trend towards harmonizing regulations across different jurisdictions is a critical development. Think of it as building a uniform road system across different countries; it makes travel easier and safer for everyone.

This push for harmonization aims to streamline compliance and create a level playing field for both platforms and investors. It simplifies things significantly, promoting innovation and efficiency without compromising investor protection. It’s a complex undertaking, but the benefits in the long run are huge.

Conclusion:

The regulatory landscape surrounding micro-investing is dynamic and constantly evolving. These five trends – KYC/AML compliance, data privacy, transparency, investor protection, and cross-border harmonization – are shaping the industry, ensuring a safer, more transparent, and efficient environment for both platforms and their users. While these regulations might seem like hurdles at times, they ultimately contribute to a more sustainable and trustworthy micro-investing ecosystem. They’re like the foundations of a sturdy house – unseen but crucial for long-term stability. The future of micro-investing is bright, and these regulatory developments are paving the way for its continued growth and success.

FAQs:

1. Q: Are micro-investing platforms safe? A: Reputable micro-investing platforms employ robust security measures and comply with relevant regulations to protect user data and funds. However, it’s always crucial to do your due diligence and choose platforms with a strong track record.

2. Q: What are the fees associated with micro-investing? A: Fees vary between platforms, but they typically include transaction fees, account maintenance fees, and potentially management fees depending on the investment strategy. Always review the fee schedule before investing.

3. Q: How do I choose a reputable micro-investing platform? A: Look for platforms with transparent fee structures, strong security measures, and positive customer reviews. Ensure they’re compliant with relevant regulations in your jurisdiction.

4. Q: What are the risks associated with micro-investing? A: Like any investment, micro-investing carries risks. market fluctuations can impact your returns, and the value of your investment can go down as well as up. It’s important to understand your risk tolerance before investing.

5. Q: Is micro-investing suitable for everyone? A: Micro-investing can be a great option for beginners, but it’s essential to assess your financial situation and investment goals before starting. If you’re unsure, seeking advice from a qualified financial advisor is always recommended.