Hey there, fellow investors! Ever feel like the world of finance is a tangled web of jargon and complicated strategies? Well, I get it. That’s why I’m here to break down some exciting trends in micro-investing-tools">micro-investing-strategies">micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing, all explained through the lens of behavioral economics. Think of it as understanding why we invest the way we do, not just how. Ready to dive in?

Micro-investing, for those unfamiliar, is the practice of investing small amounts of money regularly. Think spare change, leftover coffee money – those little sums that often disappear into oblivion. But what if we harnessed that power? What if those tiny amounts could blossom into something significant? That’s the magic of micro-investing. And understanding behavioral economics helps us maximize that magic.

Let’s explore nine key trends shaping this exciting field:

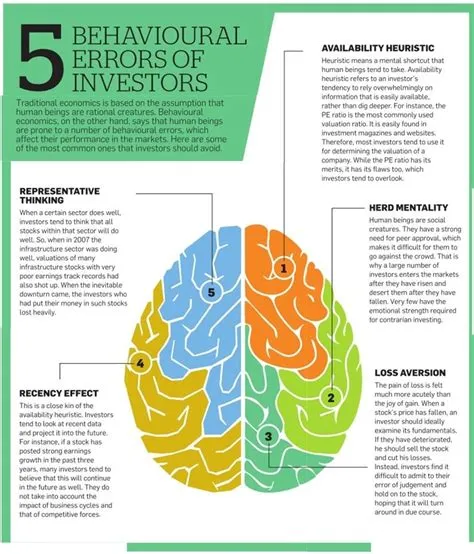

1. The Rise of Round-Up Apps: Remember that annoying change accumulating in your bank account? Round-up apps automatically round up your purchases to the nearest dollar and invest the difference. It’s almost effortless saving and investing! It leverages the power of loss aversion – the pain of losing money feels more significant than the joy of gaining it. By making saving so seamless, it avoids the feeling of losing money you could’ve spent.

2. Gamification of Investing: Many micro-investing platforms are embracing gamification. Think progress bars, badges, and leaderboards. This taps into our innate desire for rewards and achievement. This relates to operant conditioning – we’re more likely to repeat behaviors that are positively reinforced.

3. Social Investing and the Herd Mentality: Sharing your investment journey online, joining communities, and seeing what others are investing in influences our choices. This plays into the bandwagon effect – we tend to follow the crowd, believing that what’s popular must be good. While this can be positive, remember to do your own research!

4. Robo-Advisors and Automated Portfolios: Technology is simplifying investing, making it accessible to everyone. Robo-advisors offer automated portfolio management, eliminating the need for extensive financial knowledge. This addresses cognitive biases, like the fear of missing out (FOMO) or analysis paralysis, by providing simple, straightforward solutions.

5. Micro-Investing for Specific Goals: Instead of just general investment, many are using micro-investing to fund specific goals: a down payment, a vacation, or even a child’s education. This is powerful because it connects investing to a tangible, emotional goal, making it more motivating. It’s a brilliant application of goal-setting theory.

6. ESG (Environmental, Social, and Governance) Investing Takes Center Stage: More and more people are micro-investing in companies aligned with their values. This reflects the growing importance of ethical considerations in investing. It’s about aligning your investments with your moral compass.

7. Micro-Investing and Financial Literacy: Increased access to micro-investing is driving the demand for financial education. People need to understand basic investment concepts to make informed choices. This highlights the need for clear and accessible financial literacy resources.

8. The Power of Habit Formation: Successful micro-investing hinges on making it a habit. The more consistent you are, the better your results. This speaks to the strength of habit formation – even small, consistent actions accumulate significant results. Think of it like a snowball rolling downhill: it starts small, but gets bigger and bigger.

9. The Democratization of Wealth Building: Micro-investing is leveling the playing field, giving everyone – regardless of income level – the opportunity to participate in the markets. It’s a giant leap towards a more inclusive and equitable financial system.

Conclusion:

Micro-investing is more than just a trend; it’s a revolution in how we approach saving and building wealth. By understanding the underlying behavioral economics principles, you can harness your own biases and instincts to make smarter choices, build better habits, and achieve your financial goals. Remember, even small steps, taken consistently, can lead to remarkable results. So, start small, stay consistent, and watch your investments grow! The future of finance is micro – and it’s incredibly exciting!

FAQs:

1. What if I lose money micro-investing? While there’s always a risk involved in investing, micro-investing’s small contributions limit potential losses compared to larger investments. Diversification across asset classes can further mitigate risk.

2. Are there any fees associated with micro-investing apps? Many apps offer free services for smaller balances, but some may charge fees for specific features or higher account balances. It’s essential to read the terms and conditions before signing up.

3. How much should I start micro-investing with? There’s no magic number. Start with what feels comfortable for you – even a few dollars a week can make a difference over time.

4. Can I withdraw my money at any time from micro-investing accounts? Depending on the platform, you might have access to immediate withdrawals. Others might have restrictions, such as penalties for early withdrawals, so be aware of this.

5. Is micro-investing suitable for all ages and financial situations? Generally, yes. However, it’s advisable to assess your personal risk tolerance, investment goals, and financial situation before jumping in. If you’re unsure, seeking advice from a qualified financial advisor is always a good step.