Hey there, fellow micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investors! Ready to dive into the exciting world of future-forward investing? We’re talking about 2025 and beyond – a time when micro-investing is no longer a niche hobby, but a mainstream way to build wealth. But how will our investment decisions evolve? What new strategies will dominate? Let’s explore ten key decision-making trends shaping the landscape of micro-investing in 2025.

1. The Rise of AI-Powered Investment Advice: Remember those old financial advisors who felt like they spoke a different language? Well, in 2025, AI is stepping in to bridge that communication gap. Forget complicated jargon; AI-powered platforms will translate complex market data into bite-sized, personalized recommendations. Think of it like having your own pocket-sized, super-smart financial guru! It’s not replacing human advisors entirely, but it’s leveling the playing field, making informed decisions accessible to everyone. Will you trust your investments to an algorithm? It’s a question many are grappling with.

2. Hyper-Personalization: Investing Tailored to You: One size doesn’t fit all, especially when it comes to investments. In 2025, expect to see a boom in hyper-personalized investment strategies. Algorithms will analyze your risk tolerance, financial goals, and even your spending habits to create a portfolio uniquely suited to your needs. It’s like having a bespoke suit made for your financial future, tailored to your specific style and aspirations.

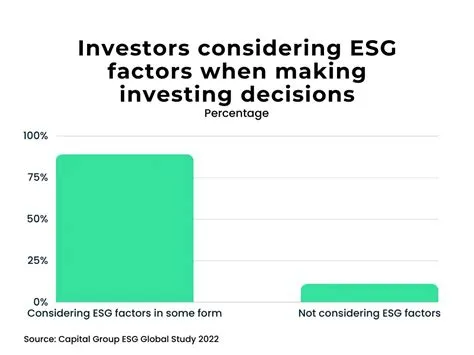

3. ESG Investing Takes Center Stage: More and more micro-investors will prioritize Environmental, Social, and Governance (ESG) factors. We’re talking about investing in companies that align with your values – businesses committed to sustainability, social responsibility, and ethical practices. It’s about making money while making a positive impact on the world. Isn’t that a win-win?

4. fractional-shares-basics">fractional-shares-and-wealth-building">fractional-share-platforms">fractional Investing: Owning a Piece of the Pie: Forget needing thousands of dollars to invest in big-name companies. Fractional investing will allow you to buy tiny pieces of stock, making the market accessible to everyone, regardless of their budget. It’s like having a slice of a delicious financial pizza, even if you can’t afford the whole pie!

5. The Democratization of Alternative Investments: Access to alternative investments like private equity and real estate will become increasingly easier for micro-investors. Platforms will streamline the process, breaking down the barriers to entry that once existed. Think of it as opening up a whole new world of investment opportunities, previously reserved for the ultra-wealthy.

6. The Power of Robo-Advisors: Robo-advisors are automated investment platforms that manage your portfolio for you. While not completely replacing human advisors, they’re simplifying the investment process, offering a low-cost, accessible way to build wealth. It’s like having a diligent, automated assistant managing your financial life. Are you ready to let a robot manage some of your money?

7. Focus on Financial Literacy: As micro-investing becomes more mainstream, there will be a greater emphasis on financial literacy. Platforms and educational resources will empower investors with the knowledge and skills needed to make informed decisions. This is crucial – wouldn’t you rather understand the “why” behind your investments?

8. Community-Based Investing: Investing doesn’t have to be a solitary pursuit. In 2025, expect to see the rise of community-based investing platforms, connecting investors with similar goals and values. Sharing knowledge and experiences can lead to better investment decisions – it’s like having a supportive squad in your financial journey.

9. The Importance of Diversification (but Smarter): Diversification will remain crucial, but its implementation will evolve. Instead of simply spreading investments across different sectors, investors will focus on strategic diversification based on AI-driven insights, ensuring optimal risk management and potential returns. It’s not just about spreading your bets; it’s about placing them strategically.

10. Long-Term Vision Over Short-Term Gains: While quick profits are tempting, the emphasis will shift towards long-term investing strategies. Patience and a long-term outlook will be key, recognizing that consistent, sustainable growth is more valuable than chasing fleeting trends. It’s like planting a tree; you don’t expect immediate fruit, but the rewards come over time.

Conclusion:

The future of micro-investing is bright! The trends we’ve discussed will empower more people than ever before to participate in the markets and build wealth. Technology, personalization, and a focus on education will play crucial roles in making this happen. Embrace these trends, learn from them, and watch your investments flourish. Remember, the journey of a thousand miles begins with a single step – or in our case, a single micro-investment.

FAQs:

1. Are robo-advisors safe? Robo-advisors use algorithms to manage your investments, but like any investment, there’s inherent risk. Choose reputable platforms with robust security measures.

2. How can I improve my financial literacy? Utilize online resources, attend workshops, and read books on personal finance and investing. Knowledge is power in the world of finance.

3. What is ESG investing, and why is it important? ESG investing considers environmental, social, and governance factors when choosing investments. It aligns your investments with your values and can potentially lead to better long-term returns.

4. Is fractional investing risky? Fractional investing carries the same risks as traditional investing. The risk depends on the underlying asset and your overall portfolio diversification.

5. How do I find a trustworthy AI-powered investment platform? Look for platforms with transparency, strong security measures, and a proven track record. Read reviews and compare features before making a decision.