Hey there, fellow investors! Ever feel like the world of finance is a giant, confusing maze? You’re not alone. But what if I told you there’s a simpler, more accessible way to dip your toes (or even dive headfirst!) into the exciting world of investing? We’re talking micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing – and it’s exploding in popularity. This isn’t your grandpa’s stock market; it’s dynamic, accessible, and constantly evolving. So, grab your metaphorical financial magnifying glass, and let’s explore the top 10 trends shaping investor sentiment in this rapidly growing field.

1. The Rise of “Spare Change” Investing: Turning Pennies into Profits

Remember those annoying spare coins cluttering your pockets? Now, they’re the seeds of your future wealth! Apps that let you round up purchases and automatically invest the difference are becoming wildly popular. It’s the ultimate “set it and forget it” approach, making investing as effortless as grabbing a coffee. Think of it as a financial fitness program for your wallet – small, consistent efforts lead to significant long-term gains. Doesn’t that sound better than letting those pennies gather dust in a jar?

2. Gamification: Making Investing Fun (and Addictive!)

Who said investing had to be boring? Micro-investing apps are cleverly incorporating game-like elements, rewarding users with virtual badges, progress bars, and even friendly competition. This gamification makes the process engaging and keeps users motivated, fostering a sense of accomplishment and encouraging consistent contributions. It’s like leveling up in a video game, except your reward is real financial growth. Pretty cool, right?

3. Socially Responsible Investing (SRI) Takes Center Stage

More and more micro-investors are prioritizing investments aligned with their values. They want to know their money is supporting companies committed to environmental sustainability, social justice, and ethical practices. This isn’t just a trend; it’s a movement, demonstrating that ethical considerations are no longer secondary in investment decisions. Want to make a difference while growing your wealth? SRI is the way to go.

4. fractional shares: Unlocking the Power of Big Companies

Ever wished you could own a piece of your favorite tech giant or established corporation, but felt intimidated by the high share prices? Well, fractional shares change everything! Micro-investing platforms now allow you to buy fractions of shares, making even the most expensive stocks accessible to everyone. It’s like having a slice of the pie instead of needing the whole thing – opens up a whole new world of investment possibilities!

5. Robo-Advisors: Your AI Investment Buddy

Feeling overwhelmed by all the investment jargon and complex decisions? Robo-advisors are automated investment platforms that use algorithms to create and manage personalized portfolios tailored to your risk tolerance and financial goals. They take the guesswork out of investing, making it simple and accessible for beginners. Think of them as your own personal AI investment guru – 24/7, at your fingertips.

6. Increased Financial Literacy: Empowering the Everyday Investor

The rise of micro-investing is accompanied by a parallel increase in accessible financial education resources. More people are learning the basics of investing, understanding risk management, and becoming more confident in making their own investment choices. This growing financial literacy is key to empowering individuals to take control of their financial futures. It’s about knowledge being power – and everyone deserves that power.

7. The Millennial and Gen Z Impact: A New Generation of Investors

Millennials and Gen Z are embracing micro-investing with open arms. They’re digitally savvy, comfortable with technology, and eager to build their wealth early. Their influence is driving innovation and shaping the future of the micro-investing landscape. They’re changing the game, and proving that investing isn’t just for the older generation.

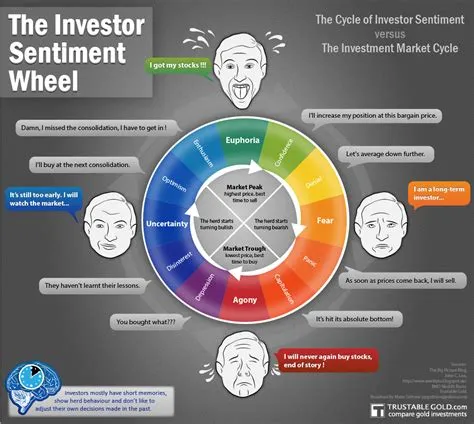

8. Focus on Long-Term Growth: Patience Pays Off

Micro-investing encourages a long-term perspective. While quick gains are tempting, the emphasis is shifting towards building wealth steadily over time. This patient approach recognizes that consistent contributions, even small ones, can yield significant returns in the long run. It’s a marathon, not a sprint – and the finish line is a secure financial future.

9. Mobile-First Approach: Investing on the Go

The convenience of mobile-first platforms is a major driver of micro-investing’s success. Investing is no longer limited to desktop computers; it’s available at your fingertips anytime, anywhere. This accessibility breaks down geographical barriers and makes investing part of our everyday lives, much like checking email or social media.

10. Diversification Made Easy: Spreading Your Risk

Micro-investing platforms offer easy diversification, allowing you to spread your investments across various asset classes, reducing your overall risk. It’s like not putting all your eggs in one basket; it’s a crucial strategy for building a resilient portfolio. It’s all about protecting your hard-earned money.

Conclusion

Micro-investing is revolutionizing the way people approach their finances. It’s breaking down barriers, making investing accessible to everyone, regardless of their income level or investment experience. The trends we’ve explored demonstrate its growing popularity and transformative potential. By embracing these trends and staying informed, you can harness the power of micro-investing to build a strong financial foundation for your future. So, take the plunge, explore the options, and start your micro-investing journey today!

FAQs

1. Is micro-investing risky? Like any investment, micro-investing carries some risk. However, diversification and a long-term strategy can help mitigate this risk. The key is to invest only what you can afford to lose and to understand your risk tolerance.

2. How much money do I need to start micro-investing? Many micro-investing platforms allow you to start with just a few dollars. The beauty of it is that it’s flexible and scalable to your budget.

3. What are the best micro-investing apps? There are several excellent options available, each with its own features and benefits. Research and choose the app that best suits your needs and investment style.

4. How can I learn more about micro-investing? Numerous online resources, including educational websites and investment blogs, provide valuable information on micro-investing strategies and best practices.

5. Can I withdraw my money easily? Most micro-investing platforms offer straightforward withdrawal processes, but the specific procedures may vary depending on the platform you use. Always review the terms and conditions beforehand.