Hey there, savvy investors (and future savvy investors)! Ever feel like you need a million dollars to start investing? Think again! The world of micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing is booming, and it’s changing the game for everyone, from seasoned professionals to complete newbies. We’re talking about platforms that let you invest spare change, literally – think rounding up your purchases to the nearest dollar and pocketing the difference. Intrigued? Let’s dive into six major investment volume trends shaping this exciting micro-investing landscape.

Trend 1: The Rise of the “Spare Change” Investor: Remember those piggy banks we had as kids? This is the grown-up version, only instead of candy, you’re investing! Micro-investing apps make it ridiculously easy to channel your loose change into investments. You’re essentially automating your savings and investments, making it less of a chore and more of a seamless part of your daily routine. Don’t you love the idea of building wealth without even really noticing it?

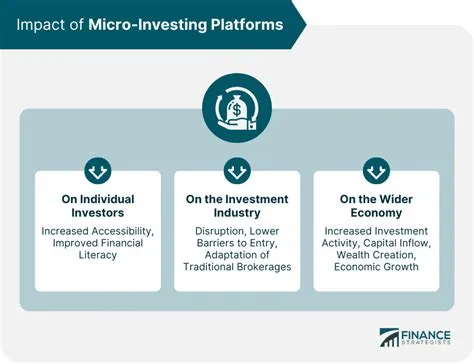

This trend is fueled by the ease of use. These apps are user-friendly, intuitive, and designed for the average person, not just Wall Street wizards. Think of it as the democratization of investing – making it accessible to everyone, regardless of their financial background or knowledge level. This accessibility is a key driver of the ever-increasing investment volume.

Trend 2: The Power of Habitual Investing: Think of building wealth like building a muscle. You don’t get ripped overnight; it takes consistent effort. Micro-investing encourages this habitual investing behavior. By making small, regular investments, you build momentum and consistency – two crucial ingredients for long-term investment success. It’s like compound interest on steroids, slowly but surely growing your portfolio over time. Isn’t that a better approach than sporadic, large investments?

This trend has led to a significant increase in the overall volume of investment, as more and more people embrace this disciplined approach to saving and investing. The sheer volume of small, regular investments adds up, creating a powerful force in the market.

Trend 3: Robo-Advisors: Your Personal AI Investment Guru: Remember those intimidating financial advisors who spoke in jargon you couldn’t understand? Micro-investing platforms often incorporate robo-advisors, AI-powered tools that manage your investments based on your risk tolerance and financial goals. These robo-advisors handle the heavy lifting – research, portfolio diversification, and rebalancing – making investing less daunting and accessible to everyone.

The cost-effectiveness of robo-advisors is another game-changer. Traditional financial advisors charge hefty fees; robo-advisors are typically much more affordable, making micro-investing even more accessible for people with limited resources. The increasing sophistication and affordability of robo-advisors is directly tied to the surge in micro-investing volume.

Trend 4: The Gamification of Investing: Who says investing can’t be fun? Many micro-investing apps gamify the experience, adding elements of friendly competition and rewards to encourage engagement. Think of it as turning investing into a game; the more you invest, the more points you earn, and the closer you get to your financial goals.

This playful approach resonates particularly well with younger generations who are more digitally savvy and receptive to gamified experiences. This gamification trend has made investing less intimidating and more attractive to a wider demographic, significantly boosting the overall volume of investments.

Trend 5: The Rise of fractional shares: What if you could own a piece of your favorite company even if you don’t have thousands of dollars to spare? fractional shares make it possible! Micro-investing platforms allow you to purchase fractions of shares, making expensive stocks accessible to everyday investors. Imagine owning a piece of Amazon or Google with just a few dollars – it’s incredibly empowering!

The ability to invest in high-value stocks that were previously out of reach has dramatically expanded the investment opportunities for micro-investors. This increased accessibility is another significant factor contributing to the growth of investment volume.

Trend 6: Increased Financial Literacy and Awareness: As micro-investing gains popularity, there’s a parallel increase in financial literacy and awareness. People are becoming more informed about investing and its potential benefits. This, in turn, fuels further growth in micro-investing volume. It’s a positive feedback loop; the more people invest, the more they learn, and the more they invest!

This trend is crucial for long-term sustainability. Informed investors are better equipped to make smart decisions, reducing risks and ensuring the continued success of the micro-investing industry. It’s not just about throwing money at investments; it’s about making informed choices.

Conclusion:

Micro-investing is more than just a trend; it’s a revolution. It’s democratizing wealth creation, making it accessible to everyone regardless of their income or investment knowledge. From the ease of “spare change” investing to the gamification of the experience and the power of robo-advisors, it’s transforming how we approach our financial future. By understanding these six key investment volume trends, you can better navigate the world of micro-investing and start building your wealth today. Remember, even small steps can lead to significant progress!

FAQs:

1. Are micro-investing platforms safe? Most reputable platforms employ robust security measures to protect your investments. However, it’s always wise to research and choose a platform with a strong track record and transparent security practices.

2. What are the fees associated with micro-investing? Fees vary depending on the platform. Some platforms charge a small percentage of your investments, while others have minimal or no fees. Always check the fee structure before signing up.

3. Can I withdraw my money at any time? Withdrawal policies vary by platform. Some allow for immediate withdrawals, while others may impose waiting periods. Review the terms and conditions of your chosen platform.

4. How much money do I need to start micro-investing? Many platforms allow you to start with just a few dollars. The low barrier to entry is a key attraction of micro-investing.

5. Is micro-investing suitable for all investors? Micro-investing can be a good starting point for beginners, but it’s crucial to understand your risk tolerance and investment goals. Consider consulting a financial advisor if you need personalized guidance.