Hey there, fellow finance enthusiasts! Ever wondered how those slick micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing apps manage to connect you with the market so seamlessly? It’s all thanks to the magic of API integrations! Think of APIs as the backstage crew of the financial world, quietly working behind the scenes to make everything run smoothly. Without them, your favorite investing app would be about as useful as a chocolate teapot. Let’s dive into the top 10 trends shaping the future of API integrations in micro-investing.

1. The Rise of Embedded Finance: Remember when buying things online meant separately going to PayPal or your bank? Now, it’s all integrated. Embedded finance is doing the same for investing. Imagine adding investment options directly within your favorite budgeting app – no more switching between apps! This seamless integration is revolutionizing how people approach micro-investing, making it as easy as buying a coffee.

2. Hyper-Personalization through AI-Powered APIs: One-size-fits-all investing is so last decade. AI-powered APIs are now analyzing your spending habits, risk tolerance, and financial goals to tailor investment strategies just for you. It’s like having a personalized financial advisor in your pocket, guiding you toward your goals with laser precision.

3. The Democratization of fractional-shares-basics">fractional-shares-and-wealth-building">fractional Investing: APIs are making fractional investing more accessible than ever before. No longer do you need thousands of dollars to own a slice of Google or Apple. APIs simplify the process, allowing micro-investing platforms to offer fractional shares with ease, opening up the market to a much wider audience. Isn’t that awesome?

4. Blockchain and Crypto Integration: Cryptocurrencies are here to stay, and APIs are bridging the gap between traditional investing and the crypto world. Imagine seamlessly buying and selling Bitcoin or Ethereum directly through your micro-investing app. This integration is gradually becoming a standard feature, reflecting the growing popularity of digital assets.

5. Enhanced Security through Robust API Gateways: Security is paramount in the financial world. Robust API gateways are becoming increasingly important for protecting user data and preventing unauthorized access. Think of these gateways as the bouncers of the financial club, ensuring only authorized parties can enter.

6. Real-time Data Feeds for Enhanced Transparency: Delayed information is a deal-breaker. Real-time data feeds, powered by advanced APIs, provide investors with up-to-the-minute information, letting them make informed decisions quickly. This transparency builds trust and empowers users to actively manage their investments.

7. Gamification APIs for Increased Engagement: Let’s face it, investing can be boring. Gamification APIs are changing that by adding elements of fun and competition to the experience. Think leaderboards, badges, and virtual rewards – all designed to keep users engaged and motivated. It’s like turning investing into a game!

8. Open Banking APIs for Seamless Account Linking: Linking your bank accounts to your micro-investing app used to be a hassle. Now, Open Banking APIs streamline this process, allowing for secure and instant account connections. This simplification removes a major hurdle, making micro-investing even more accessible.

9. Focus on User Experience (UX) through API Design: A great user experience is key. APIs are now being designed with a strong focus on UX, making micro-investing platforms intuitive and easy to navigate. This user-centric approach is crucial for attracting and retaining users. After all, who wants a confusing, clunky app?

10. The Growing Importance of API Documentation and Support: Good documentation is as important as the API itself. Clear, concise documentation and readily available support help developers integrate the APIs seamlessly. This collaborative approach fosters innovation and ensures the smooth operation of micro-investing platforms. It’s a win-win for everyone!

Conclusion:

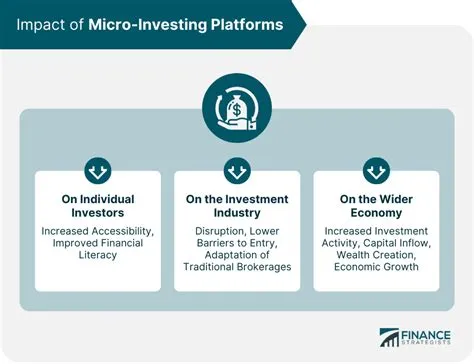

The trends we’ve discussed are reshaping the micro-investing landscape, making it more accessible, personalized, secure, and engaging than ever before. The future of micro-investing hinges on the continued evolution of API integrations. As technology advances, we can expect even more innovative and user-friendly features to emerge, further democratizing access to the financial markets and empowering individuals to take control of their financial futures. It’s an exciting time to be involved in the world of finance!

FAQs:

1. Are API integrations safe? Yes, reputable micro-investing platforms employ robust security measures, including encryption and multi-factor authentication, to protect user data and transactions. However, it’s always wise to choose platforms with a strong track record of security.

2. How do API integrations benefit micro-investing platforms? APIs allow platforms to connect with various financial institutions and data providers, offering users a wider range of investment options, improved data analysis capabilities, and a more seamless user experience.

3. What are the challenges of API integration in micro-investing? Challenges include maintaining data security, ensuring API reliability, managing regulatory compliance, and adapting to the ever-changing technological landscape.

4. What are the future prospects of API integrations in micro-investing? The future looks bright! We can expect to see even more sophisticated integrations, including AI-driven personalized investing, seamless cross-border transactions, and the integration of emerging technologies like Web3 and the metaverse.

5. Can I develop my own micro-investing app using APIs? Absolutely! Many APIs are available for developers to build their own customized micro-investing applications. However, you’ll need a strong understanding of programming and financial markets to succeed.