Hey there, future financial wizards! Ever feel like the world of investing is a tangled mess of jargon and confusing charts? You’re not alone. But things are changing. The rise of micro-investing-tools">micro-investing-strategies">micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing, combined with some seriously cool trends in financial education, is making investing accessible – and even fun – for everyone. So grab a cuppa, settle in, and let’s explore five major trends shaping how we learn about and engage with micro-investing.

1. Gamification: Turning Investing into a Game

Remember those reward charts your parents used to motivate you? Well, financial education is borrowing a page from that playbook. Gamification is huge right now, turning the often-daunting process of investing into an engaging, interactive experience. Think interactive apps that reward you for learning about stocks, quizzes that test your financial knowledge, and even virtual portfolios where you can practice investing without risking real money. It’s like learning to ride a bike with training wheels – you get the hang of it before you’re actually zooming down the hill!

This trend is particularly effective for younger generations who’ve grown up immersed in digital gaming. Instead of feeling intimidated by financial terms, they’re actively encouraged to explore and learn through play. It’s making investing feel less like a chore and more like a challenge – a fun challenge, at that. Isn’t that a fantastic way to build good financial habits early on?

2. Personalized Learning Paths: Tailoring Education to Your Needs

One size doesn’t fit all, right? The same applies to financial education. Gone are the days of generic investment advice that doesn’t consider your unique circumstances. Today, personalized learning paths are becoming increasingly popular, using algorithms and data to create a customized learning journey based on your goals, risk tolerance, and financial situation.

Think of it like choosing your own adventure in a book. You’re in charge of your learning path. Want to focus on long-term growth? You’ll get content focused on that. Interested in learning about specific types of investments? The path adjusts to accommodate your preferences. This personalized approach makes learning more relevant and effective. No more wading through irrelevant information; it’s all focused on your needs and aspirations.

3. Micro-Influencers and Social Media: Building Trust Through Authenticity

Remember when the only financial advice you got was from stuffy bankers in suits? Those days are over! Social media platforms are overflowing with micro-influencers – everyday people who are sharing their own micro-investing journeys, providing relatable tips, and building community. They’re breaking down complex financial concepts into easily digestible pieces, fostering a sense of trust and camaraderie.

These micro-influencers are like your friendly neighborhood investment guides. They’re approachable, genuine, and focused on building a community rather than just selling a product. Their authenticity resonates with followers, and their relatable experiences make the world of micro-investing feel less intimidating and more achievable. It’s less about slick marketing and more about genuine connection.

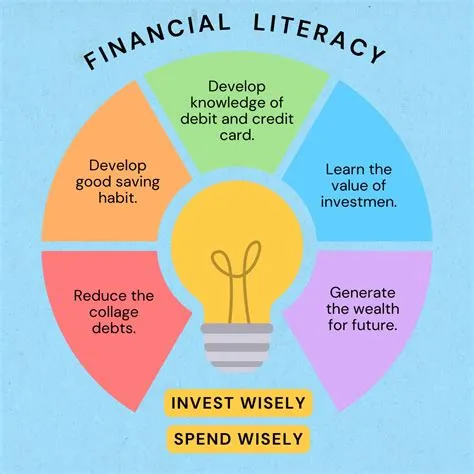

4. Financial Literacy Initiatives and Free Resources: Democratizing Financial Knowledge

Access to quality financial education used to be a privilege, often locked behind paywalls or reserved for the wealthy. However, a wave of financial literacy initiatives is making valuable resources available to everyone, regardless of background or income. Numerous free online courses, workshops, and webinars are empowering individuals with the knowledge they need to make smart financial decisions.

Think of these initiatives as the public library of finance. They’re democratizing access to information that was once scarce. This increased accessibility significantly broadens the potential reach of micro-investing, allowing more individuals to actively participate in building their financial futures. Isn’t that empowering?

5. Artificial Intelligence (AI) and Robo-Advisors: Personalized investment strategies at Your Fingertips

AI is revolutionizing many aspects of our lives, and finance is no exception. Robo-advisors, powered by AI, are making investment management incredibly accessible and affordable. These digital platforms offer automated portfolio management, personalized investment strategies, and ongoing financial advice, all for a fraction of the cost of traditional financial advisors. They’re like having your own personal financial assistant, readily available 24/7.

Robo-advisors are particularly beneficial for those new to investing, as they provide a simplified and user-friendly way to get started. They take the guesswork out of investing, making it easier to build a diversified portfolio aligned with your goals and risk tolerance. Think of them as a financial autopilot – they handle the complexities so you can focus on your other goals.

Conclusion:

The trends discussed above represent a significant shift in the way we approach financial education and micro-investing. Gamification, personalized learning, micro-influencers, free resources, and AI are breaking down barriers to entry, making the world of investing more accessible, engaging, and understandable for everyone. No longer is investing a mysterious, exclusive club; it’s becoming a practical and empowering tool that anyone can utilize to achieve their financial aspirations. So dive in, explore the opportunities, and start building your financial future today!

FAQs:

1. Are micro-investing apps safe?

Most reputable micro-investing apps are regulated and utilize robust security measures to protect your investments. However, it’s always wise to research any app thoroughly before using it and to only use apps from established and trustworthy providers.

2. How much money do I need to start micro-investing?

Many micro-investing platforms allow you to start with as little as a few dollars, making it accessible to everyone regardless of their financial situation.

3. What are the risks associated with micro-investing?

Like any investment, micro-investing carries risks, including the potential for losses. However, the ability to invest small amounts regularly can mitigate some risks associated with larger, lump-sum investments.

4. What are some good resources for learning more about micro-investing?

Numerous online resources, including websites, blogs, and educational platforms, offer valuable information about micro-investing strategies and best practices. Many reputable financial institutions also offer free educational materials.

5. How can I find trustworthy micro-influencers?

Look for micro-influencers who are transparent about their affiliations, provide well-researched content, and engage authentically with their followers. Be wary of individuals who make overly optimistic or unrealistic promises.