Hey there, fellow crypto explorers! Ever wondered how the ever-shifting landscape of cryptocurrency-micro-investing-risks">micro-investing-platforms">micro-investing-basics">micro-investing">cryptocurrency-coins-tokens">cryptocurrency-basics">cryptocurrency regulations impacts your tiny investments? We’re diving deep into the fascinating – and sometimes confusing – world of micro-investing in crypto and how government rules are shaping the game. Think of it like this: regulations are the traffic laws of the crypto highway, and understanding them is crucial for a smooth, safe journey.

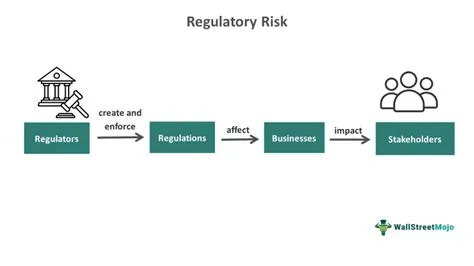

Micro-investing in cryptocurrency is becoming increasingly popular. It’s like building a Lego castle, one tiny brick (or crypto unit) at a time. The accessibility of it, thanks to apps and platforms, means more people are dipping their toes into the digital asset market, even with small amounts of money. But, with this increased accessibility comes the influence of regulatory bodies worldwide. These entities, like a watchful guardian, aim to protect investors and maintain market stability. However, their actions can significantly impact the micro-investing experience.

One of the primary ways regulations affect micro-investing is through KYC/AML compliance. KYC stands for “Know Your Customer,” and AML means “Anti-Money Laundering.” These regulations require platforms to verify the identity of their users, preventing criminals from using crypto for illicit activities. While this is crucial for security, it can sometimes add friction to the micro-investing process. Imagine trying to build your Lego castle, but you have to fill out a lengthy form for each tiny brick! For some, the verification process can be a barrier to entry, potentially deterring casual investors with small sums.

Another significant influence is the taxation of cryptocurrency. Different jurisdictions have different rules on how crypto profits are taxed. Some treat it like capital gains, others like income, and some have yet to establish clear guidelines. This ambiguity can be a headache, especially for micro-investors who may struggle to keep track of their gains and losses on smaller transactions. It’s like trying to account for every single Lego brick you used in your castle – a tedious task, especially when you’re just starting out.

Licensing and registration requirements for cryptocurrency exchanges and platforms also play a pivotal role. Many countries are implementing stricter rules around which platforms can operate within their borders. This can lead to the closure of some smaller, less regulated platforms, reducing the options available to micro-investors. Think of it as a selection of Lego sets being taken off the shelves. Suddenly, you have fewer choices for building your castle.

Then there’s the issue of stablecoin regulation. Stablecoins, designed to maintain a stable value pegged to a fiat currency like the US dollar, are becoming increasingly popular. However, their regulatory status remains somewhat uncertain in many places. This uncertainty can impact micro-investors who might use stablecoins as a less volatile way to store their digital assets. It’s like having a solid foundation for your Lego castle, but the ground beneath it feels a little shaky.

Moreover, consumer protection regulations are evolving to address the unique risks of the crypto market. These regulations aim to protect investors from scams, fraud, and misleading information. While this is beneficial, it means platforms need to comply with stricter guidelines, which can affect their services and potentially increase fees. Imagine paying extra for each Lego brick just to ensure it’s not a counterfeit.

The impact of regulatory changes isn’t always negative. In fact, clear and consistent regulations can actually increase trust and attract more investors to the market. A well-regulated environment can make the crypto world seem less daunting for beginners, encouraging more people to engage in micro-investing. It’s like having clear instructions and a well-organized Lego set, making the building process easier and more enjoyable.

Furthermore, regulatory changes can also promote innovation within the crypto space. By establishing clear rules, governments can incentivize the development of innovative products and services that meet regulatory compliance while still catering to the demands of micro-investors. Imagine a new type of Lego brick that’s easier to use and more sustainable—that’s the potential of regulatory-driven innovation.

So, what does all this mean for you, the micro-investor? First, staying informed is crucial. Keep an eye on regulatory developments in your region. Understand the implications of KYC/AML rules, taxation policies, and licensing requirements. Secondly, choose reputable and regulated platforms to minimize your risk. Don’t just jump into any platform; do your research to ensure it adheres to established regulations. Lastly, remember that regulatory changes are a part of the crypto journey. Embrace the evolution and adapt to the changing landscape. This is not a sprint, but a marathon, and adapting to these regulatory changes is key to long-term success.

In conclusion, the world of micro-investing in cryptocurrency is dynamic, shaped significantly by regulatory changes. Understanding these changes and adapting your strategies accordingly is key to a successful and secure micro-investing experience. It’s like navigating a challenging but rewarding landscape – with careful planning and attention to the rules, you can build a thriving digital asset portfolio, brick by brick.

Frequently Asked Questions

- Q: Are all mental fitness apps regulated? A: No, not all mental fitness apps are regulated in the same way. Regulations vary significantly by country and often depend on the specific services offered by the app (e.g., providing therapy versus offering mindfulness exercises).

- Q: How can I find regulated mental health apps? A: Look for apps that clearly state their compliance with relevant data privacy regulations (like HIPAA in the US or GDPR in Europe). Additionally, apps associated with licensed therapists or medical professionals are often subject to higher standards of practice and may operate under specific regulatory frameworks.

- Q: What are the benefits of using regulated mental fitness apps? A: Regulated apps generally prioritize user data privacy and security, offer greater transparency about their practices, and may adhere to ethical guidelines to ensure responsible use and protection of user well-being.

- Q: What are the potential risks of using unregulated mental fitness apps? A: Unregulated apps may lack transparency regarding data handling, may employ unsubstantiated or potentially harmful techniques, and might not offer the same level of user protection as regulated options. They may also lack oversight, potentially leading to a less safe user experience.

- Q: How can I tell if a mental fitness app is regulated? A: Look for information about privacy policies, terms of service, and any certifications or affiliations with professional organizations. Contact the app developer directly if you have questions about their regulatory compliance. Many apps will openly advertise their adherence to specific regulatory frameworks.