Hey there, fellow investor (or soon-to-be investor)! Ever dreamt of owning a piece of your favorite companies, like Apple or Google, but felt like you needed a small fortune to get started? Well, guess what? Those days are over! Thanks to fractional shares, you no longer need a king’s ransom to participate in the exciting world of stock market trends-in-fractional-shares">trends">investing. Let’s dive in and explore how you can get started.

What Are fractional shares, Anyway?

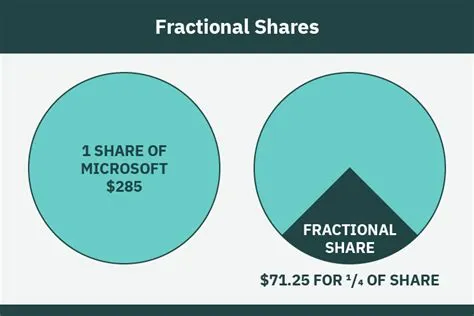

Imagine you’re buying a pizza. You wouldn’t need to buy the whole pie to enjoy a slice, right? Fractional shares work the same way! Instead of buying a whole share of a company’s stock (which can sometimes cost thousands of dollars), you can buy a fraction of a share. This means you can own a tiny piece of a big company, even if you only have a small amount of money to invest. It’s like getting a taste of the investment world without breaking the bank. Pretty cool, huh?

Why Fractional Shares Are a Game Changer

Fractional shares democratize investing. They level the playing field, allowing everyone – regardless of their financial background – to participate. Before fractional shares, the stock market felt exclusive, a playground for the wealthy. Now, it’s more accessible than ever. Think about it: you can start investing with as little as a few dollars! That’s empowering, isn’t it?

But it’s not just about accessibility; it’s about diversification too. With fractional shares, you can spread your investments across multiple companies, reducing your overall risk. It’s like not putting all your eggs in one basket – a wise strategy indeed! You can diversify your portfolio to reflect your personal interests and risk tolerance, building a more resilient and potentially rewarding investment journey.

Getting Started: A Step-by-Step Guide

Ready to take the plunge? Let’s walk through the process of buying fractional shares:

1. Choosing a Brokerage Account

You’ll need a brokerage account to buy and sell stocks, including fractional shares. Many online brokerages offer this service, so do your research! Consider factors like fees, user-friendliness, and the range of investments offered. Some popular options include Robinhood, Fidelity, and Schwab. Read reviews and compare features before making your decision. It’s like choosing the right car – you want one that fits your needs and budget.

2. Funding Your Account

Once you’ve chosen a brokerage, you’ll need to fund your account. This usually involves linking your bank account or credit card. The minimum deposit varies depending on the brokerage, but it’s often quite low – making it easy for beginners to get involved.

3. Selecting Your Stocks

This is where it gets fun! Research companies whose products or services you admire and believe have long-term potential. Consider factors like the company’s financial health, industry position, and future growth prospects. Don’t just follow the hype; do your own due diligence. Remember, investing involves risk, so always research before investing your hard-earned money.

4. Placing Your Order

Once you’ve chosen your stocks, you can place your order. Most brokerage platforms have a user-friendly interface that allows you to specify the number of fractional shares you want to buy. It’s typically a straightforward process, similar to buying anything online.

5. Monitoring Your Investments

Regularly monitor your investments to stay informed about their performance. This doesn’t mean checking every minute, but periodic reviews help you understand how your portfolio is doing. Think of it as tending to a garden – regular attention is key to growth.

Beyond the Basics: tips for Success

Investing in fractional shares is a great starting point, but success requires a bit more than just buying and holding. Here are a few additional tips:

- Start small: Don’t feel pressured to invest a large amount at once. Start with a small amount that you’re comfortable with and gradually increase your investments as you gain experience and confidence.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different companies and sectors to mitigate risk.

- Invest regularly: Consider setting up a recurring investment plan to buy shares automatically at regular intervals. This is a great way to benefit from dollar-cost averaging, a strategy that helps reduce the impact of market volatility.

- Learn continuously: The investment world is constantly evolving. Stay updated on market trends, financial news, and investment strategies. Numerous online resources, books, and courses can help you expand your knowledge.

- Be patient: Investing is a long-term game. Don’t expect overnight riches. Be patient, stay disciplined, and let your investments grow over time.

Fractional Shares: A Powerful Tool for Your Financial Future

Fractional shares have opened up the world of investing to millions. It’s a powerful tool that allows you to participate in the growth of some of the world’s most successful companies, regardless of your budget. By following these steps, you can embark on your investment journey with confidence and build a strong financial future. So, what are you waiting for? Take that first step and start building your wealth today!

Conclusion

Embarking on your fractional share investing journey is a significant step towards securing your financial future. Remember, it’s about building a long-term strategy, not chasing quick wins. By starting small, diversifying, learning consistently, and staying patient, you’ll be well on your way to achieving your financial goals. So, dive in, explore the possibilities, and enjoy the ride!

FAQs

- Are fractional shares safe? Like any investment, fractional shares carry risk. The value of your investment can fluctuate, and you could lose money. However, the risk is mitigated by diversification and investing only what you can afford to lose.

- What are the fees associated with fractional shares? Fees vary depending on your brokerage. Some brokerages charge commission fees per trade, while others offer commission-free trading. Be sure to check the fee structure before you sign up.

- How do taxes work with fractional shares? Capital gains taxes apply to profits made from the sale of fractional shares. The tax rate depends on your income bracket and how long you held the shares. It’s advisable to consult a tax professional for personalized advice.

- Can I sell fractional shares at any time? Yes, you can usually sell fractional shares anytime during trading hours, just like whole shares. However, market conditions can affect the price at which you sell.

- What if the company I invested in goes bankrupt? If the company goes bankrupt, the value of your fractional shares will likely drop to zero. This highlights the importance of diversification – spreading your investments across multiple companies to reduce your overall risk.